ITC is ineligible where there is delay in filing GSTR 3B beyond the time limit prescribed under Section 16(4) of the CGST Act

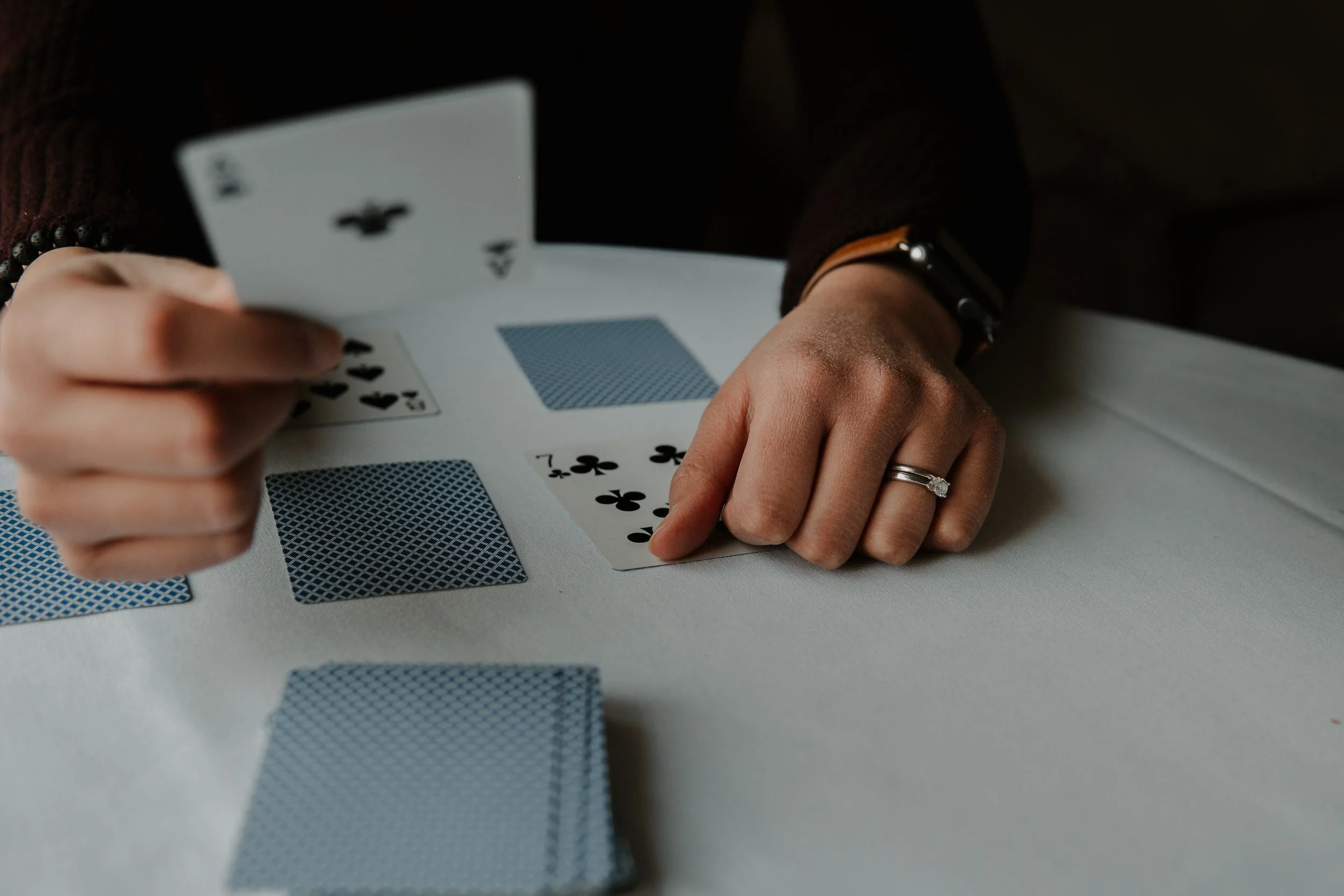

Entry 6 of Schedule III of the CGST Act provides that lottery, betting, and gambling are subject to GST, while other actionable claims are not.

Gujarat AAR holds that the sale of over-the-counter readily available food and beverages qualify as a supply of goods and not restaurant services

Recent amendments in the GST Rules, and clarifications issued by CBIC pursuant to the 48th GST Council meeting